A non-practicing 小蓝视频 lawyer in the United States for fraud has been permanently banned from participating in stock market activity in this province, according to a ruling from a 小蓝视频 Securities Commission panel.

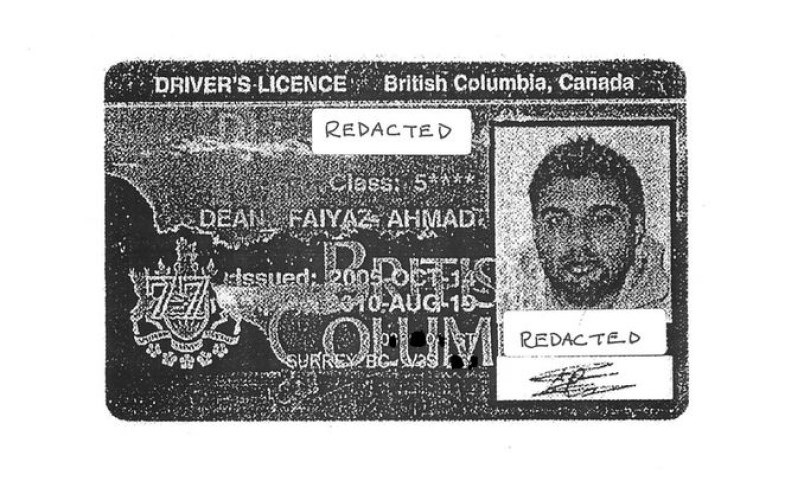

The commission’s ban against Faiyaz Dean, effective as of March 29, follows a likewise ban imposed against him by the U.S. Securities and Exchange Commission (SEC). of civil fraud charges by a U.S. court on Nov. 27, 2019 via a default judgment, after he didn’t attend his own trial.

The commission's executive director Peter Brady applied for its own ban, north of the border, on June 3, 2022.

“Dean’s fraudulent market manipulation involved artificially high stock prices which were sold to unsuspecting investors who, consequently, suffered harm when the prices fell,” the 小蓝视频SC panel stated.

“Dean claims that his role in the fraudulent scheme was ‘relatively minor.’ He is wrong. He had an essential role in the market manipulation and, because of his actions, investors were harmed,” the panel added.

The panel, according to a 小蓝视频SC statement March 31, ordered Dean to resign any position he holds as a director or officer of an issuer or registrant, and barred him from: trading shares unless done through a registered dealer; becoming or acting as a director or officer of any issuer or registrant; promoting stocks; and advising or consulting in the markets.

Unlike the U.S. civil court case, Dean did represent himself before the commission.

In opposing the 小蓝视频SC executive director’s application, Dean argued a default judgment does not make findings of facts. Furthermore, he claimed not to be a risk to 小蓝视频 markets and was not enriched by the scheme.

The panel sided with the executive director, noting default judgments do, in fact, establish the allegations as facts.

And, stated the panel, "He continues to be a serious risk to investors and British Columbia’s capital markets."

The SEC determined the 2013 pump-and-dump Dean was part of generated $34 million in illicit profits by selling stock to retail investors at inflated prices. Dean is said to have profited $120,000 for his part. The SEC in 2018 that it was able to locate $16 million in U.S. accounts and return it to harmed investors.

The SEC claim stated how Dean provided the necessary legal framework for the scheme as he helped conceal the beneficial ownership of stock held by the so-called “masterminds” of the scheme, Francisco Abellan Villena and Guillermo Ciupiak. Dean also helped create bank and brokerage accounts in the names of Argentinian nominees that were used to sell Biozoom shares. Accounts were located in Belize, Cyprus, St. Vincent and the British Virgin Islands. Central to the alleged scheme was how Dean set up a shell company with 59.7 million shares that later became Biozoom.

In relation to the scheme, Dean has also been criminally charged with conspiracy to commit securities fraud and wire fraud; securities fraud; conspiracy to commit money laundering; and money laundering. Those charges have not been proven in court and the case has also yet to proceed, according to the online court docket this week.

Dean voluntarily surrendered his licence to the Law Society of 小蓝视频 in December 2019 and is understood to be residing in Vancouver, according to the 小蓝视频SC.

Dean faces a regulatory hearing with the society, which has yet to be scheduled.

The society has accused Dean of multiple incidences of “professional misconduct or conduct unbecoming the profession.”

The society claims Dean worked with multiple companies between approximately November 2014 and December 2016 and “used or permitted the use of your firm’s trust accounts to receive or disburse, or both, some or all of approximately $1,100,000 USD and $170,000 CAD,” without either providing any legal services (as required for trusts) and/or making reasonable inquiries about the circumstances and/or making a record of any inquiries.

Dean also failed to obtain, record and verify identification information for those companies and certain individuals (whose names are redacted), the society alleges.

Dean remains free to practice law in Washington State, where he attended law school and remains an active member of the Washington State Bar Association, according to the 小蓝视频SC ruling; however, this would require entering the United States.