Women are bearing a tremendous financial burden during the pandemic, primarily because of leaving the workforce, by choice or by force.

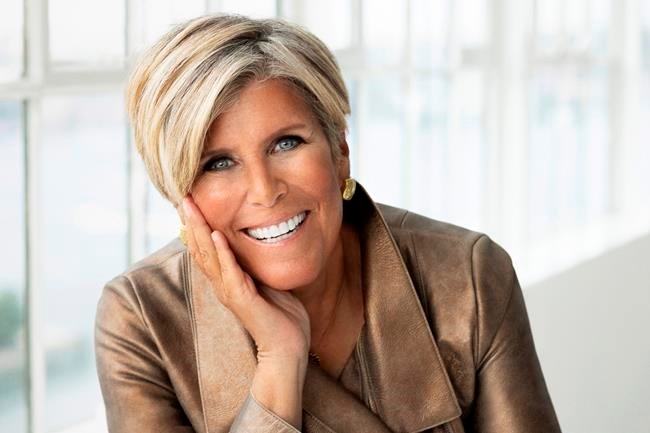

The Associated Press spoke with Suze Orman, personal finance expert and author of the podcast Women & Money, about how women can survive and emerge from this period.

Responses were edited for length and clarity.

Q: A lot of financial advice is focused on savings and investing. But what advice do you have for people who are simply struggling to get by?

A: You first have to list everything you spend money on and determine the must-spends. Buying clothes or ordering something on Amazon, those are not a must-spend. Gasoline for a car, food at a grocery store, those are must-spends. List them in terms of priority — shelter and sustenance are the top.

Then, look at the must-spends and see what you can suspend. Federal student loan payments are suspended until the end of September. Mortgages you can suspend. If you are struggling, do not pay bills you do not have to pay if you can put them on hold.

It’s important to take a really realistic look at your life, so that you don’t keep kicking the can down the road. If you are going to owe your landlord eight months of back rent and you can’t pay it, you have to start making a plan now for the day that happens.

I would pretend like tomorrow everything is back to where I owe student loan payments and I owe this and owe that and start downsizing and figure that out now.

Q: In some cases, people made some good financial choices during the pandemic — saving more, paying off credit cards, spending less. Do you think it will stick and are there any lessons you hope people take away from this?

A: While I would love to think these habits will stick, I do not. The easiest to thing to do in life is to forget and the hardest thing to do is remember.

I thought 2008 would teach people to have an emergency fund, not run up debt, to stop buying bigger houses and new cars all the time. I thought for sure that would happen. But as the stock market started to go up and go up, and they saw their 401(k) and statements expand, all of a sudden they felt rich again and they felt like they could do anything. They could go out to eat and could get bigger homes.

Even thought credit card debt has gone down...give it 10 years and this will just be whatever. A whole new group will be in their place (spending again).

I hope I am wrong.

Q: Even just a one-year employment gap can lead to a big decrease in earnings for women. For those that do return to the workforce, what can they do to make up for this period?

A: It’s not just women, it is how are people going to make up for this lost year.

You have to look at this as an opportunity. The opportunity is that you learned you need emergency savings or savings account. Or that you keep your car for 10 or so years instead of getting a new one every few years.

You make up for it by spending less than you normally would spend. You also make up for it by being active with your money. You make up for it by understanding that you pay for taxes now and opt for Roth retirement accounts. You make up for it by not buying certain investments. And by making sure if you own a home making sure it’s paid off by the time you retire.

You have to take a hard core stance between what you can and cannot do so that you are okay. You cannot save the entire world until you save yourself. That is what we have to learn. This loss could lead to the biggest gains of your life.

Q: Why do you think women need financial advice specific to their gender?

A: Women are givers...it is their natural tendency to give, give, give.

I have done every talk show and met almost every celebrity out there. I cannot tell you the famous women out there who are so wealthy — Oprah excluded — who do not know about money.

But women are willing to admit when they don't know the answers. I have yet to interview a man or go over their finances who don’t have answers to every question I have for them. But they are the wrong answers. Men are financial fakers.

Q: Some women say they need to learn more about money and investing. What do you tell them?

A: Let’s get really real. Women say they need to do it. It’s not about needing to do it. It’s about wanting to do it. If they wanted to do it — are you kidding me? They could watch CNС����Ƶ, they could read Barrons and there are financial books galore. Read my Women & Money book, listen to my podcast. It’s an excuse. It’s like saying I need to lose weight, okay then do it.

It’s not until you want to do it that you will do it. There is not a lack of resources out there. In this day and age you have a million ways you can go (to invest).

Do not tell Suze Orman that you don’t know where to go to do this. You are just fooling yourself, and you are the one that is losing out.

Q. The pandemic is expected to set women back years in terms of economic security and representation in the workforce. Do you think that they, as a group, can recover from this?

A. Absolutely. I absolutely do. I do think it could be another rough year. I don’t think it will be until March 2022 until we feel some normalcy. But I think women have the ability to recreate themselves all the time.

If you have what it takes to recover from a divorce — and most women do — or the death of a spouse, you can recover from a one or two year setback from a pandemic where the entire world was affected.

Emotionally you are not by yourself, it’s a world-wide phenomenon. You have emotional support. So you absolutely have what it takes to recover.

I believe if you learn the lesson that this taught you, you will emerge far richer, far stronger and more secure.

Sarah Skidmore Sell, The Associated Press