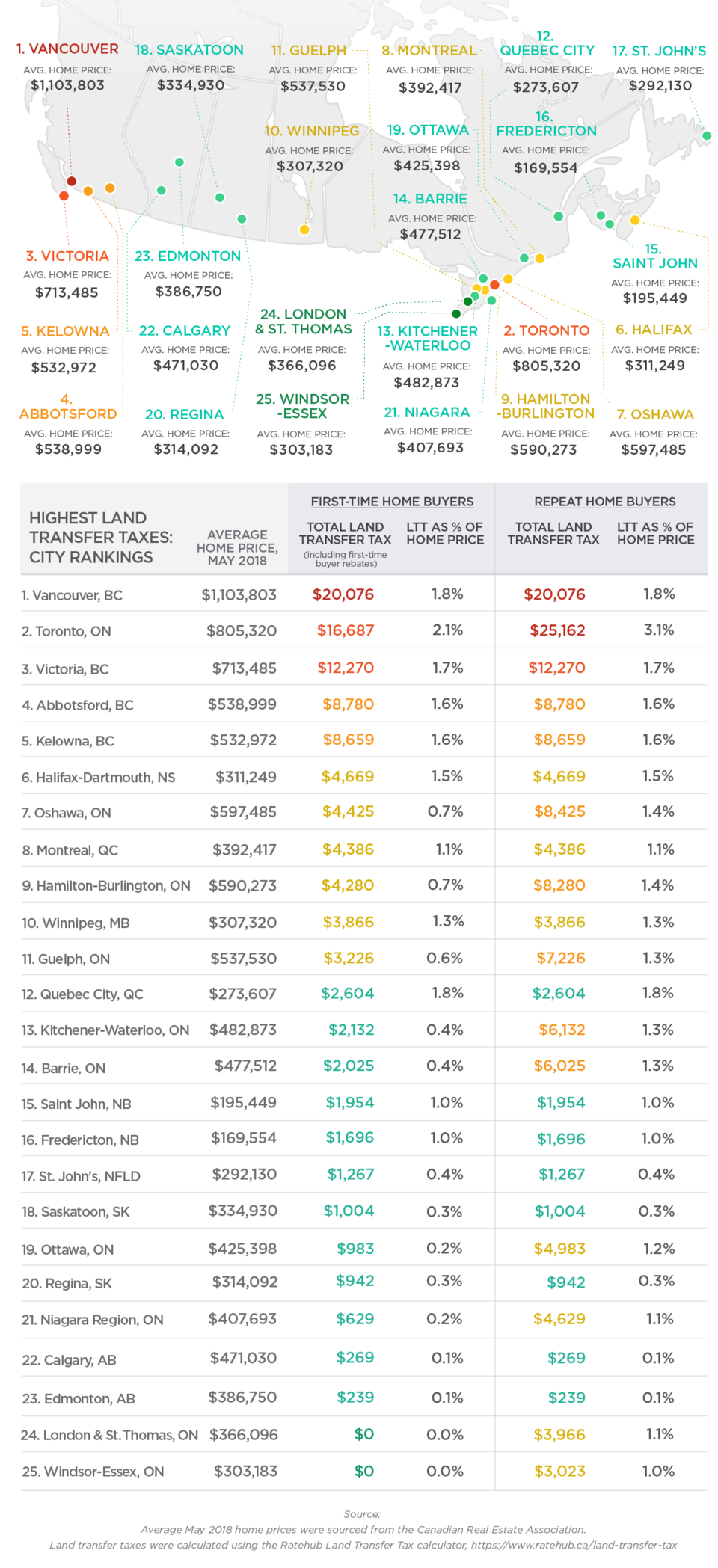

Vancouver has been named the Canadian city in which first-time homebuyers pay the highest land transfer tax (LTT) on a home purchase – known in СŔ¶ĘÓƵ as property transfer tax, or PTT – in a new .

The website ranked all the major Canadian cities in terms of how much tax both a first-time buyer and a repeat buyer would pay on the average-priced home for that city.

Vancouver was by far the highest on the first-time buyer list, with both first-time and repeat buyers paying $20,076 in tax on the purchase of an average-priced home costing $1,103,803.

Toronto was in second place with $16,687 for first-time buyers, but overtook Vancouver on the repeat buyer list at $25,162. Victoria placed third on both lists at $12,270.

The reason for Vancouver’s #1 spot on the first-time buyer list is because of its position as the priciest Canadian city for real estate, as transfer taxes are paid as a percentage of the purchase price. But Vancouver was not found have the highest percentage LTT in Canada.

That dubious honour goes to Toronto, with an LTT of 2.1 per cent for first-time buyers and 3.1 per cent for repeat buyers. Vancouver and Quebec City were in joint second in terms of percentage taxation, with LTT in both cities of 1.8 per cent for all buyers.

The cost of LTT on top of purchasing a home can be onerous, especially for first-time buyers and especially in high-priced markets, as Zoocasa’s managing editor Penelope Graham wrote in the report. “Land transfer tax is a cost that must be paid in cash upon closing and it cannot be mortgaged. This results in requiring buyers in the most expensive and heavily taxed housing markets to save for years longer to have that cash in hand, compared to more affordable markets with a moderate fee structure.”

Markets with such moderate fee structures would include the Windsor-Essex region in Ontario, as well as the London-St Thomas region in Ontario. These were the lowest-ranked cities on the list, as neither applies any land transfer tax on a home purchase.

Check out the full ranking in Zoocasa's infographic below.